September 12, 2023 | By Bruce Lahood

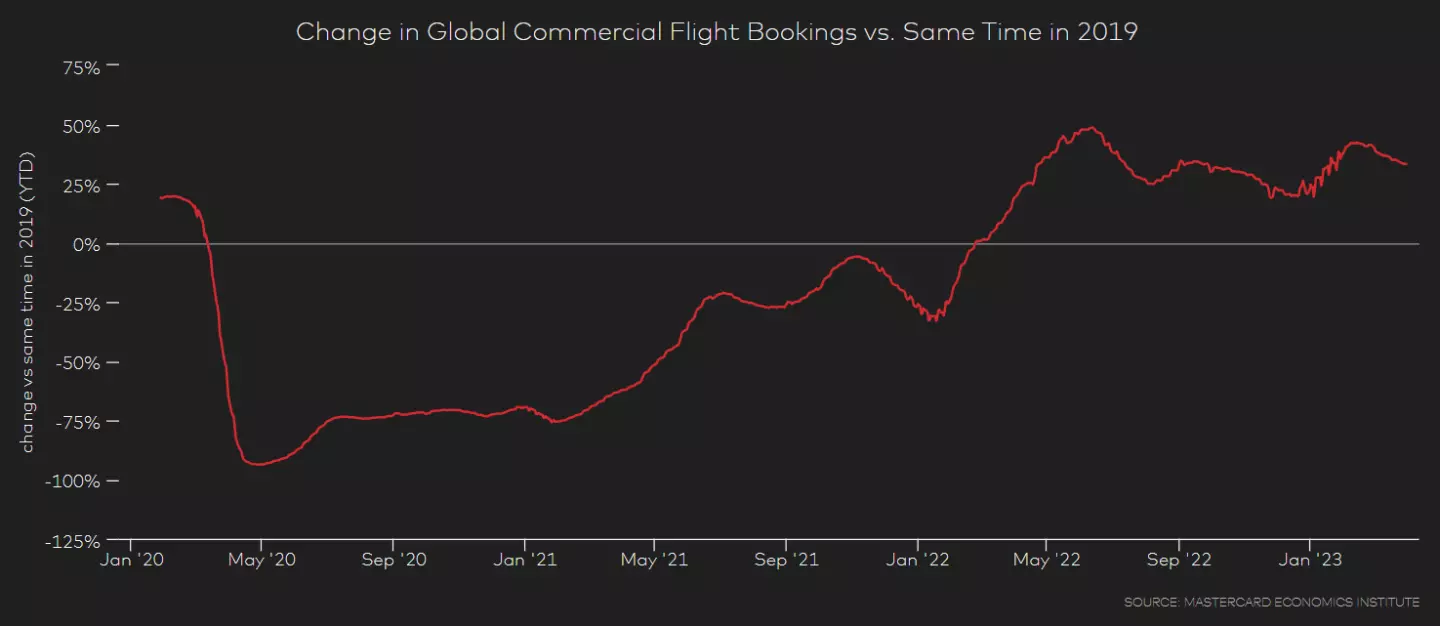

The rebounding of the leisure traveler and the emergence of the blended traveler – those who build a vacation into their business trips – has shifted the balance of demand in the travel industry.

Along with the flexible hybrid work model, business travel will continue to evolve. While pure business travelers are also returning to the highways and the skies, the traditional high frequency, road warrior segment will likely be the last to surpass pre-pandemic volumes.

Global leisure flight bookings are higher in 2023 than the same period in 2019.

Source: Travel Industry Trends 2023| Mastercard Data & Services (mastercardservices.com)

This presents an opportunity for the travel industry to capitalize on an altered landscape, re-think how they engage with their customers and configure their customer loyalty programs to appeal to a changing marketplace.

Global commercial flight bookings are recovering, but at a slower pace than leisure travel.

Source: Travel Industry Trends 2023| Mastercard Data & Services (mastercardservices.com)

A rebalanced traveler profile provides marketers with a rare opportunity to start fresh and tailor products and programs that meet the behaviors and evolving needs of these new and evolved segments.

As travel and hospitality loyalty executives evolve their programs to align with today’s travelers, here are three trends that will shape loyalty programs and the customer engagement landscape.

Lifestyle Loyalty - Brands are striving to stay relevant and top of mind with their high-value consumers by creating value in their members’ everyday lives, not just their travel experience.

Relevance and Recognition – Consumers value strong relationships and meaningful experiences with brands over transactional engagement. Increasingly, they’re seeking memorable, rewarding and enriching emotional interactions that offer choice and control and make their travel easier.

Simplicity and Accessibility - Brands are redesigning programs to provide alternative ways to maximize the benefits of program membership, including more opportunities to access benefits and unlock value. Added tiers and realizable spend thresholds will help to shape more flexible programs that are easier to understand and offer members more choice and control.

Loyalty program trend #1: Lifestyle Loyalty

Lifestyle loyalty extends well beyond the travel experience to times when travelers aren’t on the road. Progressive travel brands are finding creative ways to become part of their members’ everyday lives. And there is a significant opportunity to capitalize on new and highly profitable ancillary revenue streams.

Loyalty and consumer engagement programs have traditionally been constructed through tiers and status levels to recognize and reward the high frequency business traveler. With a shift and reweighting of the traveler segments, legacy airline and hotel loyalty programs will need to recalibrate and, more importantly, rebalance their offerings toward recognition and benefits rather than overly rely on points and member discounts.

The same can be said for co-brand credit card offerings. With a noticeable and likely sustainable shift in the segments that generate travel demand, card programs need to have a more intimate understanding of their less frequent, leisure traveler. By better understanding spend by category and brand, and affinity by levels of spend and purchase patterns, cobrand programs can create and communicate more contextually relevant and compelling content that earns the consumer’s attention and engagement.

The success of this strategy is anchored in how well a brand understands its valued members’ daily routines, leveraging customer data and insights to incorporate relevant partners and employing sophisticated marketing techniques to drive incremental spending.

Loyalty program leaders and cobrand travel marketers (in close collaboration with their banking and payments partners) must find innovative ways to convince members and cardholders to turn to their preferred travel brand as part of their everyday lives. Data-driven lifecycle marketing and triggers together with personalized promotions that prompt consumer engagement and generate incremental spend become a critical ingredient. Not only does this maintain a vital connection with members between travel bookings, but it also serves to help retain valuable members from becoming dormant or shifting their allegiance to another brand.

Lifestyle loyalty necessitates the formation of partner ecosystems that amplify the brand and gives program members and cobrand cardholders more reasons to stay connected.

A cobranded credit card isn’t the only means to construct a lifestyle offering. Travel brands can leverage existing partnerships and sponsorship assets to present members with more reasons to engage and be recognized for their loyalty. The opportunity exists for travel companies to develop partnerships that resonate with less-frequent travelers when they aren’t traveling. Partnerships with brands that match members’ day-to-day lives help travel brands stay top of mind when travel is being considered.

Singapore Airlines developed an innovative, blockchain-powered means for members to use their frequent flyer mileage currency to earn and redeem products and services as part of their everyday life. Kris+ offers its users a simple, app-enabled method to transact, with hundreds of merchants, brought to life through active marketing campaigns, merchant funded offers and gamification to engage its members.

During the global pandemic, Hyatt teamed up with Headspace to offer its World of Hyatt members a service to help them wind down, stress less and sleep soundly. The partnership serves as a natural extension of their corporate commitment to wellness and wellbeing and positions the brand as a considerate advocate for the needs of its guests.

The creation of a partner network that offers utility and extended benefits, well beyond the typical travel sales cycle and touch points, will enable travel brands to retain and nurture loyalty with their valued members.

Loyalty program trend #2: Relevance and Recognition

Relevance

The pursuit of simplicity in program design can be undermined by the marketing that is tasked to bring it to life. Member communications can play a vital role in ensuring that program delivery represents and illuminates the intent behind the loyalty strategy and design.

A combination of communication context, content, channel mix, and most importantly, the overall customer lifecycle contact plan, take responsibility for ensuring that the loyalty value proposition makes its way to market in the shape and form intended.

Digging deeper, a common challenge that many travel brands face is the inability to effectively inaugurate and educate a new member into their program. This onboarding phase marks one of a handful of opportunistic battlegrounds for marketers who are looking to reconcile the challenges of distilling complexity in simple messaging with commercial opportunities that can have a significant impact on revenue performance.

Hotel loyalty programs offer a valuable insight to the challenge. Many global hotel brands rely heavily on their on-property marketing to acquire new members. All too often the guest’s check-in experience and path to their room is interrupted by a front desk agent offer to sign up. With typically little or no context or content, the onus is then placed upon the marketing communications that follows to effectively educate a new member on the virtues of why and what they have just joined.

Brands, in their quest to drive the next transaction, can lose sight of the fact that many of their newest members have not been fully introduced into the program that they are now a part of. A carefully constructed and choreographed contact plan can deliver relevant and digestible content to prepare the groundwork for profitable and sustainable customer relationships.

Recognition

Travel is a service business defined by experiences, delivered by people for the benefit of people. While the benefits of travel loyalty such as status, upgrades, and the ability to redeem points and miles for free travel are universally valued, it’s the human element that provides ample room for loyalty brands to further invest to fuel the emotional connection with their highly prized members.

For the contemporary traveler, it’s not just about the currency. Consumers seek out brands who have a higher purpose and stand for something greater than what they offer. And loyalists expect more than just mile and point credit for their custom, placing greater emphasis on recognition to inspire them to return to the brands they love, again and again.

Three macro forces that have cultivated that shift present new challenges and an equal abundance of opportunity for brands and loyalty. The last three years have materially impacted mileage and points balances with many travelers continuing to earn through cobranded travel credit cards yet facing limited availability and higher redemption rates to burn that stockpile of currency.

Secondly, during the same timeframe, a global pandemic deprived people of an unrestricted lifestyle and reminded everybody of the innate human need for social interaction. That certainly applies to travel which is all about connecting people, human emotions, and customer service.

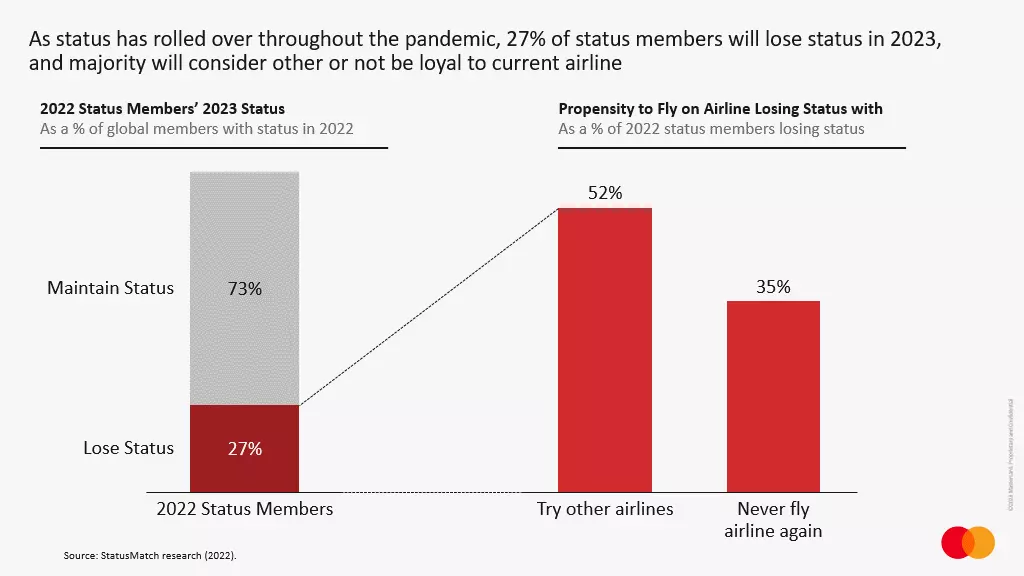

Lastly, from a loyalty program perspective, many loyalty and tenured travelers have fallen off the status cliff because of the effects of a pandemic, restricted corporate travel policies, and whole new way of working. The psychological ‘let down’ of being downgraded and possibly the feeling of being discarded by the brand after years of loyalty has created an unexpected tension between considered loyalists and the brands who are trying to win their wallets. That fall from grace plays into a loyalist’s affinity (or lack thereof) with their ‘go-to’ travel brand and brings into question brand attractiveness, and the virtues of a loyalty program.

This is where human behavior and traditional loyalty programs collide and unlock an opportunity – to rethink and recalibrate loyalty constructs to address a consumer pain point which is unlikely to go away. These factors have all contributed to what is a seismic shift in the way many consumers view loyalty programs. Miles and points are expected, recognition and experiences are what people really yearn for. Travel brands need to acknowledge the shift and reweight propositions toward recognition and experiences to account for what members value now, more than ever.

Loyalty program trend #3: Simple and Accessible

Loyalty programs are built to attract, engage and retain valuable customers. Over time, they’ve become rather elaborate value propositions, underpinned by an ever-growing array of tiers and status levels, features and benefits, ways to earn and burn, and partnerships.

The net effect is that members are finding it harder to understand, engage with, and get maximum value out of these complicated offerings. That not only leads to unrealized value for members, but also limits the opportunities for brands to win the hearts and wallets of their most valuable loyalists.

Brands are making a concerted effort to return to their roots and the fundamentals that were a trademark of the past by streamlining and simplifying their program propositions. Consider American Airlines, which relaunched their AAdvantage program with the explicit goal to rid of complicated elite qualifications as they introduced the simplicity of tracking one metric: Loyalty Points. The program gives members more ways to attain status as they earn miles and Loyalty Points by flying, dining, shopping, and using an AAdvantage credit card. AA’s intent is clear: Make their program more accessible and easier to navigate to help their members reach their goals.

The real purpose of a program is to lock in the loyalty of a valuable customer, and to help the member achieve their goals, enabling them to get the most out of their relationship with the brand. But when you take a 40,000-foot view of an entire loyalty program offering, it can be a very complex labyrinth of tiers and thresholds, partners, and products.

Members view program engagement more like traversing a tunnel, navigating toward the next trap door to unlock value to recognize their progress. Loyalty programs are beginning to design a more accessible and attainable series of tiers and thresholds that entice the member to seek out more benefits and value and, in return, deliver incremental bookings and revenue to the travel brand.

IHG has deployed a deliberate strategy to break down the member’s journey into more realistic and attainable thresholds to unlock benefits and rewards. The rebranded IHG One Rewards program enables members to unlock rewards every 10 nights that they stay. Milestone Rewards starts at 20 qualified nights, and members can choose a reward every 10 nights they stay each calendar year, up to 100 nights.

Programs that are easy to understand offer more possibilities for active customer engagement. And when the program inspires and convinces a member to pursue the next tier or threshold, brand loyalty makes more sense and feels more achievable.

The strategy is simple. While the onboarding phase is where the program takes responsibility for starting the engine for a new member, once effectively inaugurated, and educated, the member is firmly positioned in the driver's seat. Established members are now in control of what they want to achieve through their relationship with the program, as well as dictate the speed at which they plan to move through the program.

A program’s ability to understand its customers and address their needs and pain points is another vital element of contemporary programs. Marketers willing to forego short-term revenue for deeper member engagement inevitably will earn the right to a sustainable relationship and ensuing profits.

Taking away barriers to products and services that enhance the core proposition will lead to a better customer experience, which inevitably forms habits and builds loyalty. Programs that are easy to join, easy to understand, and easy to engage with will attract and retain high-value consumers.

Conclusion

For an industry that is recognized as a pioneer in loyalty, the programs of today are not necessarily representative of the needs of the future traveler. Constant innovation in program design and delivery is essential. Change is born out of consumer needs and pain points complemented by ambitious commercial goals and objectives. Successful programs effectively balance these two, often conflicting, priorities.

Competitive advantage comes from leadership willing to push beyond the boundaries and break the mold to unlock customer value. And often it’s the pragmatic and personalized solutions that win favor with customers and generate the greatest impact.

About Mastercard loyalty and personalization strategy consulting services

Mastercard’s Loyalty and Personalization Consulting practice drives transformative solutions for ambitious brands, fostering authentic, profitable customer relationships. We leverage an unmatched set of consumer and behavioral data to offer market insights, anticipate consumer trends that empower business decisions, and enhance customer lifetime value.

We have a broad spectrum of talent with deep expertise across vertical markets, data strategy and marketing technology. We combine that industry knowledge with a consumer-centric mindset to serve as trusted advisors, facilitating meaningful business transformations in partnership with our clients.

To learn more about trends in the broader travel industry, read Travel Industry Trends 2023. To work with us to develop and execute successful loyalty strategies that drive stronger customer relationships, please reach out to your Mastercard representative or request a demo.